It has been a long couple of weeks since the crypto swarm was celebrating in Miami.

Coinbase Global pioneer Brian Armstrong had an individual fortune of US$13.7 billion (S$19 billion) as of late as November and about US$8 billion toward the finish of March. It is currently US$2.3 billion, as indicated by the Bloomberg Billionaires Index, after an auction in computerized monetary standards from Bitcoin to Ether set off a steep decrease in the market worth of Coinbase, the biggest United States cryptographic money trade.

The association’s portions have tumbled almost 86% since their April 2021 first sale of stock till Wednesday (May 11), after the organization cautioned that exchanging volume and month to month executing clients were supposed to be lower in the second quarter than in the first.

It has brought up issues about Coinbase’s capacity to endure the sharp decrease in crypto costs, driving Mr Armstrong to take to Twitter to guard the organization. There is “no gamble of insolvency” even in the midst of a “dark swan” occasion and clients’ assets are protected, said Mr Armstrong, the company’s CEO.

A man walks by a Bitcoin sign in Chiltiupan, El Salvador, on Nov. 18, 2021.Jose Cabezas / Reuters

Then, at that point, there is Mr Michael Novogratz. The CEO of crypto dealer bank Galaxy Digital has seen his fortune plunge to US$2.9 billion, from US$8.5 billion toward the beginning of November. He has been a hero of TerraUSD, the algorithmic stablecoin that is currently in danger of a total breakdown in the midst of a breakdown in the cost of a crypto token in a similar biological system, Luna.

“I’m presumably the main person on the planet who has both a Bitcoin tattoo and a Luna tattoo,” Mr Novogratz said at the Bitcoin 2022 gathering in Miami on April 6.

Extremely rich person crypto fortunes that expanded throughout the course of recent years are vanishing after an auction that started with tech stocks gushed out over into computerized cash. Bitcoin, the most well known digital money, and Ether have both fallen more than 50% since their record highs toward the end of last year.

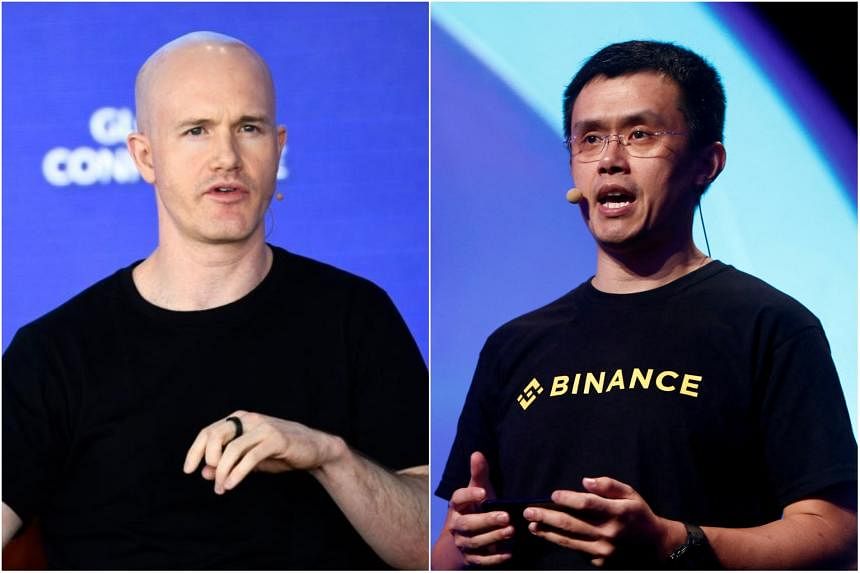

Coinbase Global founder Brian Armstrong (left) and Binance CEO Zhao Changpeng both reported personal fortune losses. PHOTOS: REUTERS

The most effective method to develop your cash and profession

Get a Head Start with ST’s new week by week bulletin

While practically all crypto holders have endured abundance declines, probably the greatest and most apparent misfortunes are concentrated among pioneers behind trades, where brokers trade computerized monetary forms.

To some extent on paper, Mr Zhao Changpeng, the CEO of firmly held Binance, has lost a significantly bigger fortune than Mr Armstrong or Mr Novogratz.

He appeared on the Bloomberg abundance file in January with a total assets of US$96 billion, one of the world’s biggest. By Wednesday, that had contracted to US$16 billion, utilizing the typical undertaking worth to-deals products of Coinbase and Canadian crypto firm Voyager Digital as a reason for the computations.

Crypto trades in the US give off an impression of being experiencing even more a slump rather than their worldwide rivals. Exchanging volumes at Coinbase have consistently fallen starting from the start of the year, while all the more universally centered Binance saw an increase in volume last month. Binance’s US-centered business, by correlation, experienced significantly more extreme decays than Coinbase’s.

Crypto business people and siblings Tyler and Cameron Winklevoss, prime supporters of opponent crypto trade Gemini, have each lost about US$2.1 billion – or around 40% – of their abundance this year. The fortune of Mr Sam Bankman-Fried, CEO of crypto trade FTX, has fallen by half since the finish of March to about US$13 billion.

Mr Armstrong isn’t the main Coinbase extremely rich person losing cash. Prime supporter Fred Ehrsam, a previous Goldman Sachs Group dealer, is at present worth US$1.3 billion, down a greater number of than 60% this year.

Mr Armstrong claims 16% of Coinbase and controls 59.5 percent of its democratic offers, as per the organization’s 2022 intermediary explanation, while Mr Ehrsam has a 4.5 percent stake and controls 26% of its democratic stock.

Coinbase’s securities have additionally plunged, as of late exchanging line with probably the most hazardous garbage evaluated notes.

Bitcoin drooped beneath $27,000 Thursday without precedent for more than 16 months, as digital money markets expanded their misfortunes in the midst of fears over rising expansion and the breakdown of a dubious stablecoin project.

The cost of bitcoin plunged as low as $26,595.52 Thursday morning, as per Bitstamp information. That denotes the initial time bitcoin has sunk underneath the $27,000 level since Dec. 30, 2020.

As of 1:30 a.m. ET, bitcoin was exchanging at $27,061, down 15% as of now.

Ether, the second-greatest computerized cash, failed to as low as $1,789 per coin. It’s whenever the symbolic first has fallen underneath the $2,000 mark since July 2021.

Ether was last down 23% at a cost of $1,852.

Financial backers are escaping from digital currencies when securities exchanges have plunged from the highs of the Covid pandemic on fears over taking off costs and a decaying monetary standpoint.

U.S. expansion information out Wednesday showed costs for labor and products hopping 8.3 percent in April, surprisingly high by examiners and near the most elevated level in 40 years.

Additionally burdening dealers’ consciences is the defeat of troubled stablecoin convention Terra.

TerraUSD, or UST, should reflect the worth of the dollar, however it plunged to under 30 pennies Wednesday, shaking financial backers’ trust in the purported decentralized finance space.

House board of trustees seats request that tech organizations document proof of war violations in Ukraine

Stablecoins resemble the financial balances of the scarcely managed crypto world. Advanced money financial backers frequently go to them for wellbeing in the midst of unpredictability in the business sectors.

However, UST, an “algorithmic” stablecoin that is supported by code as opposed to cash held in a save, has attempted to keep a steady worth as holders have rushed for the leave all at once.

Starting around Thursday morning, UST was exchanging at around 62 pennies, actually well underneath its expected $1 stake.

Luna, another Terra token that has a drifting value and is intended to assimilate UST cost shocks, deleted 97% of its worth in 24 hours and was last worth only 30 pennies — even not exactly UST.

Financial backers are terrified about the ramifications for bitcoin. Luna Foundation Guard — an asset set up by Terra maker Do Kwon — had amassed a multibillion-dollar heap of bitcoin to assist with supporting UST in the midst of emergency.

The trepidation is that Luna Foundation Guard will sell an enormous part of its bitcoin possessions to support its ailing stablecoin. That is an unsafe bet, not least on the grounds that bitcoin is itself an inconceivably unstable resource.

Adding to financial backers’ feelings of dread Thursday was a drop in the worth of tie, the world’s greatest stablecoin. The token at one point slipped under 99 pennies. Business analysts have long expected that tie might not have the necessary measure of stores to reinforce its dollar stake in case of mass withdrawals.